Seed production in EU - 2024

"Seed production in EU - 2024" : download the presentation

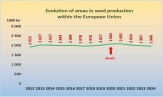

In 2024, after two years of decline, the area approved for field crop seed production (1) in the European Union stabilised at 1,968,153 ha (-0.4%). The trend is in line with that for cereal acreage, which accounts for 48% of all acreage (excluding fine vegetables and flowers). A majority of countries are seeing their acreage decline, offset by remarkable increases in Italy (+13.6%), Spain (+9.3%), Greece (+27%) and Croatia (+29.7%).

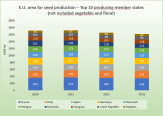

France, the leading producer in the EU with 338,940 ha, is down by 3.0% to 338,940 ha, ahead of Italy (234,085 ha), Spain (210,188 ha), Germany (170,865 ha; -1%) and Poland (139,845 ha; +0.6%).

France remains the world's leading producer of field seeds. It maintains its leadership in corn, oilseeds, fiber crops and pulses. Spain remains leader in straw cereals, ahead of Italy and France. Denmark dominates the market for forage grasses, Italy for small-seeded legumes and beetroot, and the Netherlands for seed potatoes.

[1] Excluding vegetables

Straw cereals are by far the most important species produced, with a total of 947,966 ha, or 48% of cultivated area excluding fine vegetables and flowers. In decline since 2020, the trend is towards stability. This is mainly due to a 5% drop in soft wheat acreage (411,287 t), compounded by declines in triticale (3.1%; 52,975 ha) and spelt (-41%; 2,458 ha).

Spain remains the leader in straw cereals with 127,832 ha (+1.9%), ahead of Italy (121,281 ha; +2.1%) and France (114,247; -4.5%). France remains the leading soft wheat producer with 64,188 ha (-3.5%), ahead of Germany (42,992 ha; -3.2%) and Romania (42,007 ha; -17.5%). Spain remains the market leader for barley with 48,671 ha (+9%), ahead of Germany (31,206 ha; +2.3%) and France, whose acreage remains stable at 30,583 ha. Durum wheat acreage rose by 2% to 119,079 ha. In Italy, the leading durum wheat producer, acreage remained stable (+1%; 70,473 ha). Most countries saw sharp falls, notably Spain (-7%; 18,180 ha) and France (-15%; 6,158 ha), offset by strong increases in Greece (+20%; 14,626 ha), Slovakia (+30%; 3,237 ha) and Hungary (+21%; 2,116 ha). After three years of decline, oat acreage is back on the rise and rebounded by 14% to 56,574 ha, benefiting a large majority of EU countries, notably Sweden (+13%; 7,333 ha), Finland (+12.5%; 7,020 ha) and Poland (+51%; 6,684 ha). In Spain, the leading producer, acreage fell by 17% to 7,981 ha.

With a 5% drop in 2022 and 2023, maize acreage fall by 25.6% to 128,266 ha in 2024. All producer countries are following a sharp downward trend, starting with France, the leading country for this species, whose area is down 23% to 63,678 ha, ahead of Romania (18,210 ha; -36.5%) and Hungary (15,690; -38%).

Oilseed acreage fell by 2% to 127,153 ha. Most species showed significant declines, particularly sunflower (-6.9%; 36,732 ha) and linseed (-42%; 3,375 ha), while rapeseed remained stable at 23,222 ha. Soybean growth slowed (+1.3%) to 56,981 ha.

The area under oilseeds fell by 2% to 127,153 ha. Most species show significant declines, in particular sunflower (-6.9%; 36,732 ha) and linseed (-42%; 3,375 ha), while rapeseed remained stable at 23,222 ha. Soybean growth slowed (+1.3%) to 56,981 ha.

In soybean, the trend is strongly declining in a majority of countries except for Italy, the leader for this species, whose surface area continues to increase significantly (+14%; 15,762) followed by Croatia (7,799; +4.5%), Romania (-6%; 7,020 ha) and Hungary, with a 17.3% jump to 6,419 ha. France totals 5,526 ha (-11%) behind Austria (-10%; 5,752 ha).

Sunflower area is down again (-6.9%) to 36,732 ha. All countries are following the trend except Spain, whose area jumped by 18.5% to 10,592 ha after losing 4.3% last year. France remains the leader for this species, but sees its area fall by 4.4% to 15,740 ha. Romania and Italy record a decrease of 14.4% to 4,302 ha and 28.7% to 2,489 ha respectively. In Portugal, the area decreases by 16% to 2,356 ha.

Rape areas remain stable at 23,222 ha. The trend is significantly downward for a majority of countries. France, the leading producer, shows an increase of 8.4% to 11,795 ha ahead of Spain, up from 8.6% to 5,164 ha. In Germany, the third largest producer, areas show a clear decrease of 17% to 2,644 ha ahead of Italy (761 ha; +36%).

In 2024, forage areas remained stable at 453,430 ha thanks to leguminous crops which jumped by 26% to 224,277 ha allowing for notable declines in grasses (-15%; 184,434 ha) and cruciferous plants (-23%; 30,330 ha).

Area declines due to significant decreases in most countries, notably Denmark (-23%; 75,876 ha), Poland (-14%; 46,934 ha), Sweden (-12%; 14,164 ha) and Slovakia (-28%; 7,976 ha) offset by significant increases in Italy (+41,5% ; 70,352 ha), Espagne (+15% ; 36,716 ha), Hongrie (+16% ; 34,917 ha), Roumanie (+39% ; 10,871 ha), Grèce (+28% ; 9,826 ha) et Lettonie (+63% ; 9,812 ha).

Grasses are down for the third consecutive year. The trend affects a large majority of countries, including major supplier countries such as Denmark, which is the largest producer of these species, with an area declining by 26% to 68,079 ha, followed by Poland (-12%; 19,811 ha and Germany (-11% ; 19,069 ha). France is behind with 10,716 ha (-12%). Strong increases were observed in Hungary (+58% ; 7,398 ha), Italy (3,904 ;21%) and Romania (3,415 ha ; 81%).

5% of the land area is covered by ryegrass. The English ryegrass dominates with 56 556 ha (-23%) ahead of the Italian ryegrass (36 950 ha; +17%). Followed by the strongly declining fescue (-24%), mainly red fescue (18,961 ha; -40%). Note a rebound of 19% in black oat (10,684 ha).

5 % des surfaces sont occupées par le ray-grass. Le ray-grass anglais domine avec 56 556 ha (-23 %) devant le ray-gras italien (36 950 ha ; +17%). Viennent ensuite les fétuques en forte baisse (-24 %), principalement la fétuque rouge (18 961 ha ; -40%). Notons un rebond de 19 % en avoine rude (10 684 ha).

Areas under small-seed legumes show a 19% increase to 169,438 ha. The trend is observed in most countries, but mainly in Italy, the EU’s leading producer, whose areas have risen by 42.5% to 61,154 ha. France, the second largest producer country, stabilizes at 22,516 ha, ahead of the Czech Republic and Hungary, which show 14% increases to 14,799 ha and 13,477 ha respectively. The observed trend is mainly driven by alfalfa, up 16%, a species largely majority in the Community area with a total of 81 452 ha. Clovers are not left behind with a growth of 24% led by red clover (+18.6%; 28 199 ha), Alexandrian clover (+64.4%; 25,314 ha) and crimson clover (+15.5%; 20,738 ha).

Large-grain pulses jumped 54% to 54,839 ha. This is mainly for vetches, whose areas show an exceptional growth of 55.7%, totaling 54,222 ha. Common vetches account for 70% of the market in broad-seeded pulses, totalling 38,309 ha. Spain dominates the market for large-grain legumes with 20 807 ha (+48,5%), ahead of Greece and Lithuania with 64.6% to 6,556 ha and 25.2% to 5,753 ha respectively. The trend is strongly upward in almost all countries.

Cruciferous areas, on the other hand, decrease by 23% to 30,330 ha. The situation is the result of significant declines, notably in Poland, the leading producer, whose area fall by 30.5% to 9,795 ha, as well as in the Czech Republic (-34,5% ; 4 818 ha) and in Slovakia (-60% ; 2 208 ha). In Hungary, the second largest producer, areas increase by 2.6% to 5,668 ha and in Lithuania, they rise by 40.8% to 2,217 ha. The trend is driven by mustard crops, which are falling significantly (-42.5%) to 14,418 ha. the forage radish grows by 9% and becomes majority with 14 734 ha.

After four seasons of decline, potato areas show a 5.7% recovery at 103,347 ha. The trend is benefiting a large majority of countries, particularly in the Netherlands, the largest producer, whose area increases by 2.3% to reach 38,504 ha ahead of France (+5.5% ; 21 358 ha), Germany (+5.9% ; 17 548 ha), Poland (+14 % ; 6 278 ha) and Denmark (+19.6 % ; 5 992 ha).

The area under protein crops shows significant growth of 12.4% to 117269 ha. Peas (forage and protein crops), up 10%, reach 75 949 ha and the broad bean jumps 17.6% to 31 270 ha. Lupin increases by 13% to 10 051 ha. The trend is observed in a majority of countries. Germany, the leader for these species, sees its area increase by 3.6% to 17,071 ha, ahead of Spain (67.5% ; 16,349 ha), Poland (+35 % ; 12 953 ha) and the Czech Republic (+20 % ; 11 789 ha). France, the second largest producer in 2023, sees its area fall by 17% to 11,171 ha.

Flax areas show a rebound of 34% to 56,235 ha. This is mainly fibre flax which reached 52,516 ha, its highest level ever recorded, an exceptional growth of 45.3%. In contrast, oilseed flax continues to decline (-35.9%) to total 3,719 ha. The trend is driven by France, the leading producer country, whose surface area shows an exceptional rebound of 46.6% to 46,628 ha. To a lesser extent, Belgium and the Netherlands record notable increases of 12% to 4,225 ha and 65% to 2,355 ha respectively.

Beet area reached its highest level since 2017, with a total of 12,493 ha, a 32% increase. Sugar beets, the majority, increase by 36% to 11,838 ha, while forage beets decrease by 9.4% to 655 ha. The two species combined, the trend is driven by the first six producing countries, led by Italy (+69%; 7,050 ha) ahead of France (+3.2 % ; 4 655 ha) and Poland whose area shows a jump of 20% to 254 ha.

The dried vegetable areas (beans, lentils, chickpeas and garden peas) showed a remarkable increase of 57% to total 14,932 ha. The trend is driven by lentils. Their area doubled to 6,845 ha, followed by chickpeas which increase 42% to 6,683 ha. Garden peas account for 1,256 ha (+2.7%) and green beans down 19.5% totaling 149 ha. Areas are rising strongly in the main producer countries. France, the leader for these species, shows a growth of 23% to 5 312 ha, closely followed by Spain whose area has more than doubled (5 114 ha), Italy (+71 % ; 2 067 ha), Hungary (+0.5 % ; 1 206 ha) et la Greece (+44 % ; 1 041 ha).

Summary note made by SEMAE (France)